Inside Washington: Regulations Loosen as Election Tightens

The year 2020 has been unlike any other in my memory, and the U.S. Congress and Washington, DC at large has not been left untouched by the events of this year. In the United States, the 2020 regulatory landscape for oil and natural gas has been relatively positive as many Federal regulations for the industry have loosened, but our industry experienced an unprecedented shock worldwide due to the disruption of world oil markets by Saudi Arabia and Russia, plus the COVID-19 pandemic. In this article, I will highlight 2020 Congressional action as well as action taken by the Administration that are important for our industry.

Congress:

COVID-19 Aid

I am sure it comes as no surprise that the focus of the U.S. Congress in 2020 has been on COVID-19 aid. To date, Congress has passed three main phases of COVID-19 stimulus bills:

- Coronavirus Preparedness and Response Supplemental Appropriations Act (R. 6074), providing $8.3B in funding for developing a vaccine and preventing further spread of the virus.

- Families First Coronavirus Response Act (R. 6201), providing $100B in funding for worker assistance, including emergency paid sick leave, food assistance, and unemployment payments.

- CARES Act (R. 748), providing $2T as the major stimulus package to support major industries through the Mainstreet lending program, the Paycheck Protection Program for small businesses, and direct payments to families.

Unfortunately for the oil and gas industry, none of these bills provided funding for the Strategic Petroleum Reserve or any other direct aid to the industry. Nor did they, however, include any tax incentive provisions requested by environmental advocates or the renewables sector, either. Additionally, the airlines have avoided carbon emission reduction targets in exchange for federal funds.

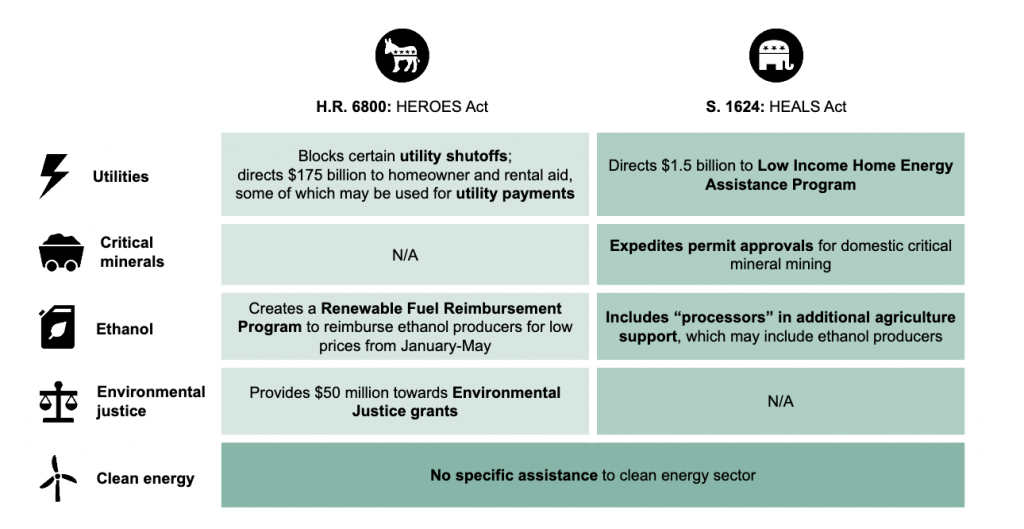

The next COVID-19 stimulus package has competing bills in the House of Representatives and the Senate: HEROES Act and HEALS Act, respectively. For the broader energy sector, generally, the differences are laid out below. Note once again, no potential direct aid for the oil and gas industry is in either bill:

(Graphic from the National Journal.)

At the current moment of writing this article, it is unclear whether Congress will be able to come together to enact a next round of COVID aid for the country.

Appropriations

The U.S. Congress is Constitutionally tasked to pass 12 appropriation bills every year to fund the Federal government. In recent years, however, Congress has passed Continuing Resolutions, ‘Omnibuses’ or ‘Minibuses’ to keep the Federal government funded.

Of the 12 appropriation bills, there are two that are most important for our industry:

- Interior Appropriations: R. 7612: funds the Department of the Interior, which oversees all leasing on federal public lands.

- Energy and Water Appropriations: H.R. 7617: funds the Department of Energy (DOE), including the DOE’s Office of Fossil Energy, allocates research dollars at our National Laboratories, among many other items.

To date, the U.S. House has passed 10 of the 12 Appropriations bills, and the U.S. Senate has passed zero of the 12. With the fiscal deadline approaching at the end of September, and the election approaching, it is likely a Continuing Resolution will be passed in Congress to extend FY 2020 levels until after the election.

The Administration

The Administration has been busy in 2020 finalizing some regulatory changes within the Environmental Protection Agency (EPA) and elsewhere to ease the regulatory burden on the industry.

One of these changes scales back the EPA Obama-era methane regulations on the upstream part of the sector. Overall, the rules re-classify the processing and production of gas and oil separately from transmission and storage for the purposes of the new source performance standards. The new rule:

- removes NSPS regulations of methane and volatile organic compounds (VOCs) for transmission and storage of gas and oil;

- targets methane only indirectly through regulation of VOCs for new gas and oil production facilities, thereby avoiding regulation of downstream parts of the sector.

Another important law for our industry is the National Environmental Policy Act (NEPA). Via the Council for Environmental Quality, the Administration reforms NEPA, making significant changes to the federal environmental review process:

- Narrows NEPA’s scope by restricting the types of projects that require an impact review

- Removes requirement for consideration of cumulative effects and climate effects

- Imposes review process deadlines: two years for larger projects, one year for smaller ones

Opening up Alaska

On August 17, Interior Secretary David Bernhard, announced the Department is moving forward with lease sales in the Arctic National Wildlife Reserve (ANWR) to allow oil and gas drilling. The Bureau of Land Management (BLM) is set to open up 1.56 million of the 19.6 million acres in ANWR as it makes 400,000-acre lease sales in 2021 and 2024.

Additionally, the Administration has decided to open up 18.7 million acres for leasing in the National Petroleum Reserve, expanding the acreage by 60%.

Carbon Emissions

Finally, the White House has sought three changes to Obama-era regulations on carbon emissions since 2017. The changes impact the Corporate Average Fuel Economy (CAFE) Standards, Clean Power Plan (CPP), and Carbon capture and storage (CCS) requirements.

The Trump Administration CAFE Standards now mandates a 1.5% annual increase in auto emissions standards, from a previous 5% under the Obama Administration. The CPP now has less stringent emissions limits on coal and natural gas plants. Finally, the Administration is also seeking to remove CCS requirements for new coal plants.

Elections

I have worked in Washington, DC for almost two decades and what I have consistently heard from businesses across the spectrum is they can live with fair and sensible regulation, but what they cannot live with is uncertainty. The upcoming elections will no doubt have an impact on the direction in which the regulatory pendulum is headed. While there are many important elections this November involving U.S. House races in key oil and gas districts, U.S. Senate races vying for control of the Senate, and of course the Presidential race, the question regarding where the regulatory pendulum will ultimately swing remains. Regardless, IADC’s Government and Industry Affairs team will be ready to advocate for the issues critical to our industry before the U.S. Congress and U.S. agencies.